热门资讯> 正文

Powell's Rate Cut Signal Triggers Small-Cap Rally, Gold Makes Record Highs, Dollar Tumbles: 7 ETFs On The Move

2024-08-23 23:24

Jerome Powell's interest rate remarks Friday ignited a rally in stocks, bonds, and commodities, while the U.S. dollar plunged as traders solidified their bets on rate cuts.

Financial markets responded positively to Fed Chair Jerome Powell‘s remarks at the Jackson Hole symposium, where he said the ‘”time has come for policy to adjust.”

The Fed chair said he is more confident the economy is on a sustainable path back to the 2% inflation target, allowing the Fed to finally shift its focus to labor market conditions.

“We do not seek or welcome further cooling in labor market conditions,” he said, adding the Fed has “ample room to respond” by adjusting its policy should further weakening in labor market conditions occur.

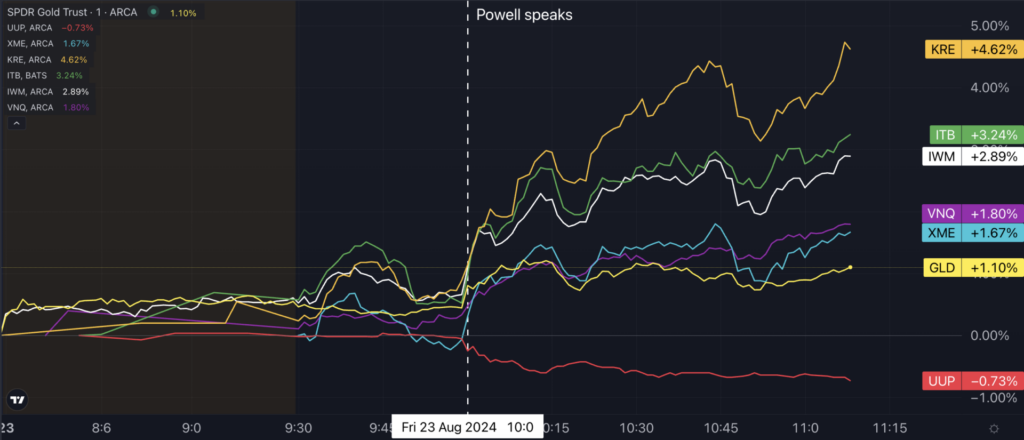

7 Key ETFs React To Powell’s Jackson Hole Speech

A greenback gauge, as tracked by the Invesco DB USD Index Bullish Fund ETF (NYSE:UUP), tumbled by 0.7% at 11 a.m. ET., extending its weekly decline to 1.4% — the worst performance it has recorded this year.

Driven by expectations of lower interest rates and a weakening dollar, gold prices surged to a new all-time high of $2,530 per ounce following the speech, with the SPDR Gold Trust (NYSE:GLD) climbing by 1.1%.

Wall Street initially rallied before paring back some gains as traders assess the economic outlook.

Small caps, instead, substantially outperformed large-cap indices. The iShares Russell 2000 ETF (NYSE:IWM) soared 2.9%, on track for its strongest session since July 16.

Within sectors, real estate stocks rallied, with the Vanguard Real Estate ETF (NYSE:VNQ) up 1.8%, hitting the highest levels since September 2022.

Interest-rate sensitive industries saw significant gains following Powell’s remarks, with homebuilders, regional banks and miners leading the market.

The SPDR S&P Regional Banking ETF (NYSE:KRE) jumped 4.6%, while the iShares U.S. Home Construction ETF (NYSE:ITB) climbed 3.2%, and the SPDR S&P Metals & Mining ETF (NYSE:XME) advanced 1.7%.

Don't miss the opportunity to dominate in a volatile market at the Benzinga SmallCAP Conference Oct. 9-10 at the Chicago Marriott Downtown Magnificent Mile.

Read Next:

- Financial Crime Weekly: Health Care Provider To Pay $3.85M For Medicare Scheme, Co-Conspirators To Pay $70M For Vitol Bribery Scheme

Jerome Powell and Wall Street illustration. Photo: Federalreserve/Flickr Photo: Bylolo/Unsplash