热门资讯> 正文

Top 3 Energy Stocks That Could Lead To Your Biggest Gains This Month

2024-09-19 19:07

The most oversold stocks in the energy sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Gran Tierra Energy Inc (NYSE:GTE)

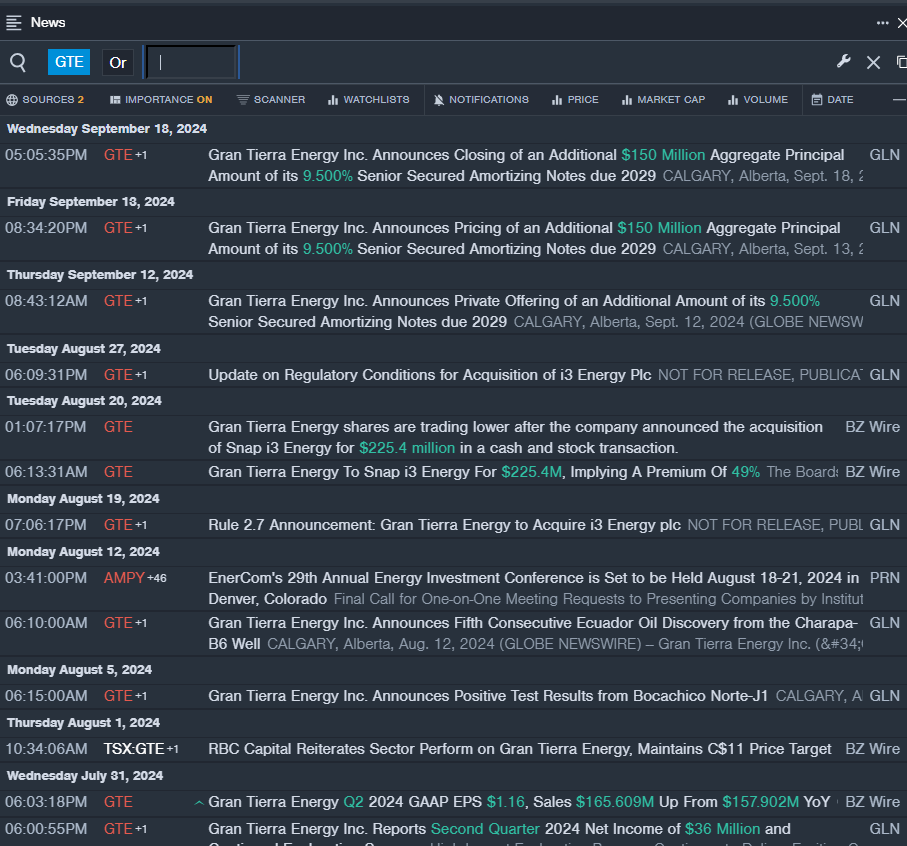

- On Sept. 18, Gran Tierra Energy announced the closing of an additional $150 million aggregate principal amount of its 9.500% senior secured amortizing notes due 2029. The company's stock fell around 31% over the past month and has a 52-week low of $4.72.

- RSI Value: 27.50

- GTE Price Action: Shares of Gran Tierra Energy fell 6.4% to close at $5.90 on Wednesday.

- Benzinga Pro's real-time newsfeed alerted to latest GTE news.

Vivakor inc (NASDAQ:VIVK)

- On April 22, VirnetX Holding announced that it has established an advisory board comprised of four retired senior U.S. Air Force leaders. The company's stock fell around 28% over the past month. It has a 52-week low of $0.44.

- RSI Value: 27.07

- VIVK Price Action: Shares of Vivakor fell 0.7% to close at $1.43 on Wednesday.

- Benzinga Pro’s charting tool helped identify the trend in Vivakor stock.

Crown LNG Holdings Ltd (NASDAQ:CGBS)

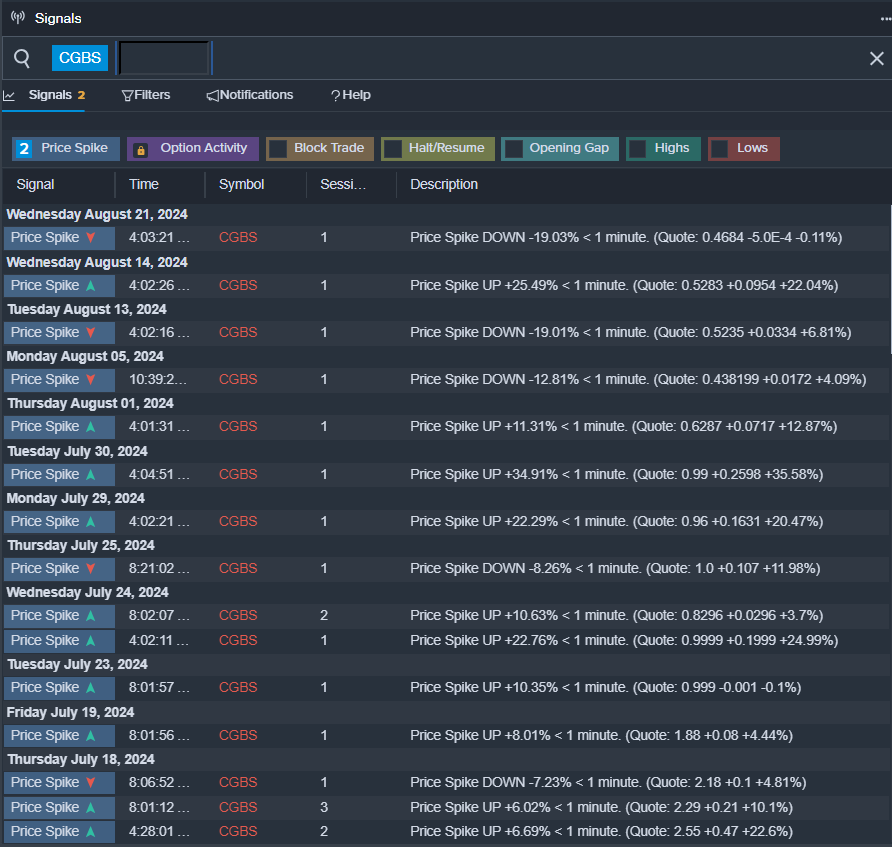

- On Sept. 17, Crown LNG announced it received a Nasdaq notification regarding Nasdaq listing rule 5550(a)(2) for failing to meet its minimum bid requirements. The company's shares fell around 45% over the past month and has a 52-week low of $0.26.

- RSI Value: 22.60

- CGBS Price Action: Shares of Crown LNG Holdings fell 10.6% to close at $0.26 on Wednesday.

- Benzinga Pro’s signals feature notified of a potential breakout in Crown LNG Holdings shares.

Read Next:

- FedEx Gears Up For Q1 Print; Here Are The Recent Forecast Changes From Wall Street’s Most Accurate Analysts

推荐文章

风险及免责提示:以上内容仅代表作者的个人立场和观点,不代表华盛的任何立场,华盛亦无法证实上述内容的真实性、准确性和原创性。投资者在做出任何投资决定前,应结合自身情况,考虑投资产品的风险。必要时,请咨询专业投资顾问的意见。华盛不提供任何投资建议,对此亦不做任何承诺和保证。