热门资讯> 正文

Exploring Invitation Homes's Earnings Expectations

2025-10-29 01:03

Invitation Homes (NYSE:INVH) is gearing up to announce its quarterly earnings on Wednesday, 2025-10-29. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Invitation Homes will report an earnings per share (EPS) of $0.27.

Anticipation surrounds Invitation Homes's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

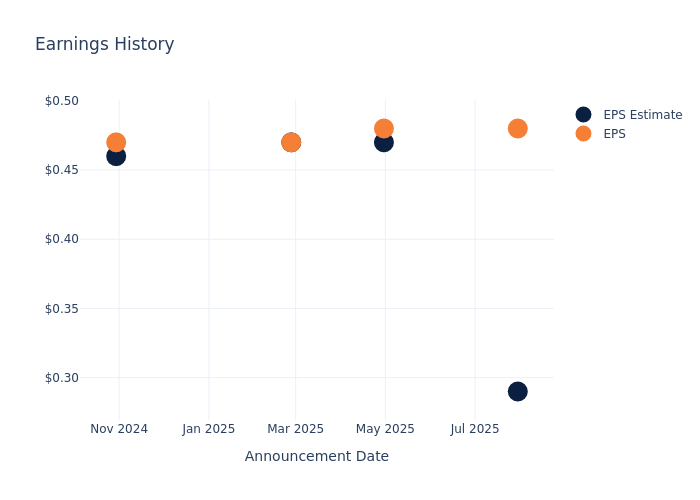

Earnings Track Record

The company's EPS beat by $0.19 in the last quarter, leading to a 2.33% drop in the share price on the following day.

Here's a look at Invitation Homes's past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.29 | 0.47 | 0.47 | 0.46 |

| EPS Actual | 0.48 | 0.48 | 0.47 | 0.47 |

| Price Change % | -2.00 | 3.00 | 6.00 | -5.00 |

Performance of Invitation Homes Shares

Shares of Invitation Homes were trading at $28.88 as of October 27. Over the last 52-week period, shares are down 14.67%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analysts' Perspectives on Invitation Homes

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Invitation Homes.

Analysts have given Invitation Homes a total of 9 ratings, with the consensus rating being Outperform. The average one-year price target is $34.1, indicating a potential 18.07% upside.

Analyzing Analyst Ratings Among Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of Sun Communities, American Homes 4 Rent and Equity Lifestyle Props, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Sun Communities, with an average 1-year price target of $137.6, suggesting a potential 376.45% upside.

- Analysts currently favor an Outperform trajectory for American Homes 4 Rent, with an average 1-year price target of $38.14, suggesting a potential 32.06% upside.

- Analysts currently favor an Buy trajectory for Equity Lifestyle Props, with an average 1-year price target of $65.25, suggesting a potential 125.93% upside.

Peer Metrics Summary

The peer analysis summary provides a snapshot of key metrics for Sun Communities, American Homes 4 Rent and Equity Lifestyle Props, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Invitation Homes | Outperform | 4.28% | $401.29M | 1.45% |

| Sun Communities | Neutral | 2.69% | $310.10M | 17.77% |

| American Homes 4 Rent | Outperform | 8.03% | $263.00M | 1.47% |

| Equity Lifestyle Props | Buy | 0.21% | $185.69M | 5.58% |

Key Takeaway:

Invitation Homes ranks first in revenue growth among its peers. It has the highest gross profit margin. However, it has the lowest return on equity.

All You Need to Know About Invitation Homes

Invitation Homes owns a portfolio of over 85,000 single-family rental homes. The company focuses on owning homes in the starter and move-up segments of the housing market with an average sale price around $350,000 and generally less than 1,800 square feet. The portfolio is spread across 17 target markets that feature high employment and household formation growth with over 70% of the portfolio in the Western US and Florida; 15 of the 17 markets featuring average rents lower than homeownership costs.

Understanding the Numbers: Invitation Homes's Finances

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Positive Revenue Trend: Examining Invitation Homes's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 4.28% as of 30 June, 2025, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Real Estate sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 20.64%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Invitation Homes's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 1.45%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Invitation Homes's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.76%, the company may face hurdles in achieving optimal financial returns.

Debt Management: With a below-average debt-to-equity ratio of 0.85, Invitation Homes adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Invitation Homes visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.