热门资讯> 正文

Why Teradyne Stock's Current Rally Carries More Risk Than It Appears

2025-12-17 21:49

Teradyne (NASDAQ:TER) is currently in Phase 2 of its 18-phase Adhishthana cycle on the weekly charts. While recent optimism has surfaced following Goldman Sachs' upgrade of the stock from Sell to Buy, the stock's internal cycle structure suggests that hidden risks may be developing beneath the surface. Let's examine Teradyne through the lens of the Adhishthana framework to understand why this phase may not be as supportive as it appears.

Analysing Teradyne Stock's Phase 2 Structure

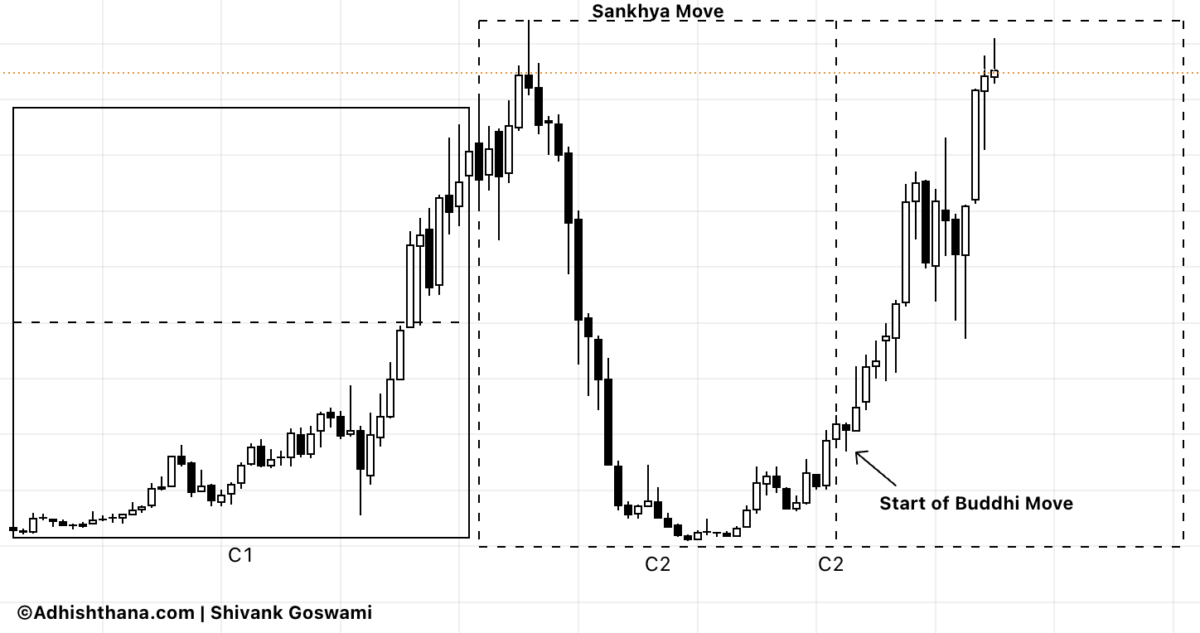

Under the Adhishthana Principles, Phase 2 unfolds in two distinct segments. The first is the Sankhya period, typically characterised by consolidation or corrective behaviour. This is followed by the Buddhi period, where stocks often experience strong, sustained upside momentum.

For reference, Figure 1 illustrates a textbook Phase 2 structure using Carvana as an example.

In Teradyne's case, however, the structure has deviated from this natural progression. Throughout its Sankhya period, the stock traded with pronounced bullishness, rallying by more than 165%. This type of misalignment often creates structural stress within the cycle. When early strength appears in the wrong segment, the market frequently corrects the imbalance later, often as the stock transitions into Buddhi rather than accelerating further.

Teradyne has now entered its Buddhi phase, and very early signs of pullback have already emerged. This behaviour aligns with what we have observed historically when Phase 2 develops out of sequence.

We previously highlighted a similar risk in MP Materials, at the point when all major institutions where bullish on the stock. Since then, the stock has corrected by over 30%, reinforcing the importance of respecting cycle structure rather than sentiment alone.

Investor Outlook

Despite the recent upgrade from Goldman Sachs, Teradyne's Phase 2 structure remains concerning. Upgrades that arrive as a stock transitions into a potentially corrective segment of the cycle often lag the underlying risk.

While short-term rallies may still appear, especially given that the monthly structure remains supportive, the internal misalignment within Phase 2 keeps the risk skewed to the downside. This setup suggests that volatility could persist. Investors should approach the stock with caution and avoid chasing the current rally.

Investors already holding the stock should consider hedging their positions, while those looking to enter would be better served by delaying any aggressive buying decision for now.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.